Some Known Factual Statements About Ia Wealth Management

Based whether you’re trying to find a wide-ranging financial plan or are merely wanting financial investment direction, this concern will be crucial. Economic advisors have different methods of recharging their customers, and it will surely typically depend on how often you deal with one. Make sure you ask when the specialist follows a fee-only or commission-based system.

The 2-Minute Rule for Investment Consultant

When you must invest some strive to find the appropriate monetary consultant, the job is generally worth it if the specialist offers good advice and assists place you in an improved financial position.

Vanguard ETF offers are not redeemable straight using the issuing fund apart from in large aggregations really worth huge amount of money (https://www.pinterest.ca/pin/1151162354742517956). ETFs are at the mercy of industry volatility. When purchasing or selling an ETF, you are going to spend or get the economy cost, which might be almost than internet resource price

The Basic Principles Of Independent Investment Advisor Canada

Generally, though, an economic specialist could have some type of training. Whether it’s not through an academic program, it's from apprenticing at an economic advisory firm (https://ca.enrollbusiness.com/BusinessProfile/6539368/Lighthouse%20Wealth%20Management,%20a%20division%20of%20iA%20Private%20Wealth). Individuals at a firm who're however studying the ropes are often known as associates or they’re part of the administrative staff members. As mentioned early in the day, though, lots of advisors originate from different fields

The Main Principles Of Investment Representative

Meaning they need to put their customers’ best interests before their, among other things. Different financial experts are people in FINRA. This is likely to imply that they've been agents just who additionally provide financial investment guidance. As opposed to a fiduciary requirement, they legally must follow a suitability criterion. Therefore discover an acceptable basis for their investment recommendation.

Their particular names usually state everything:Securities licenses, on the other hand, are more regarding the sales part of investing. Economic advisors that happen to be additionally brokers or insurance policies agencies generally have securities certificates. Should they immediately buy or sell stocks, bonds, insurance items or provide economic information, they’ll require particular certificates linked to those items.

The Single Strategy To Use For Investment Representative

Always make sure to ask about financial advisors’ fee schedules. To obtain these details alone, check out the firm’s Form ADV this files with the SEC.Generally talking, there's two types of pay buildings: fee-only. investment representative and fee-based. A fee-only advisor’s main kind of settlement is by client-paid fees

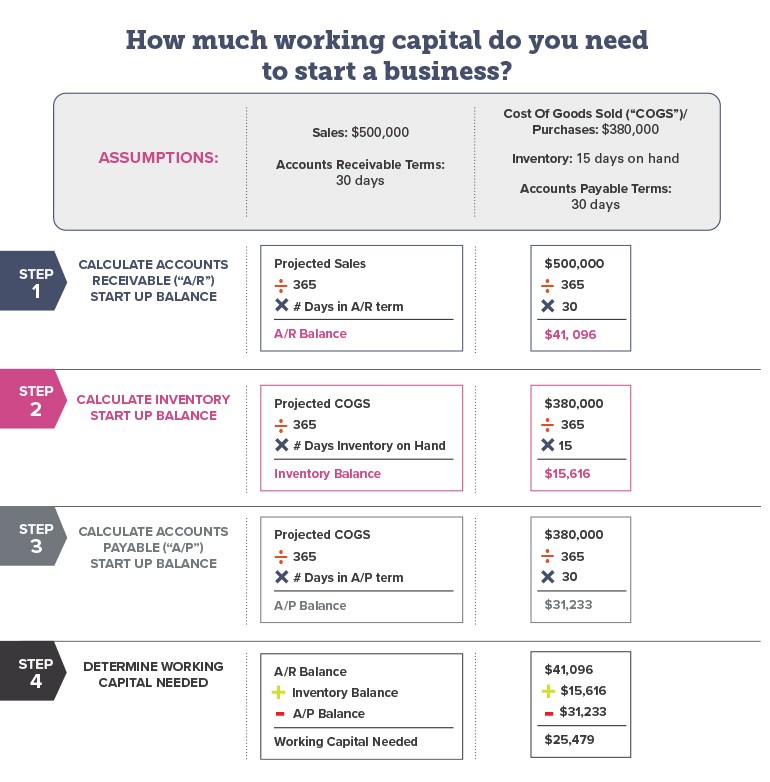

Whenever wanting to realize how much an economic advisor prices, it's important to know there are various of compensation strategies they may utilize. Here’s an overview of that which you might encounter: Financial advisors may paid a portion of your as a whole assets under administration (AUM) for dealing with finances.

3 Simple Techniques For Retirement Planning Canada

59percent to 1. 18%, typically. independent financial advisor canada. Normally, 1per cent can be regarded as a requirement for a million bucks. Numerous analysts will reduce the percentage at larger amounts of possessions, so you are investing, say, 1% the basic $one million, 0. 75per cent for the following $4 million and 0

Whether you need a financial expert or not is determined by how much cash you have in assets. Opt for the level of comfort with money control subject areas. When you have an inheritance or have not too long ago come into a sizable sum of cash, after that an economic specialist may help reply to your monetary questions and manage your cash.

Fascination About Lighthouse Wealth Management

Those differences could seem apparent to prospects within the expense industry, but many buyers aren’t aware of all of them. They might think about monetary planning as compatible with financial investment administration and guidance. Also it’s true that the contours between your occupations have become blurrier before four years. Expense advisors are increasingly focused on providing holistic monetary planning, as some people look at the investment-advice portion become basically a commodity and so are seeking wider expertise.

If you’re searching for holistic preparation information: a monetary coordinator is suitable if you’re seeking wide financial-planning guidanceon your expense collection, but other parts of one's program too. Find those that name themselves economic coordinators and have prospective planners if they’ve obtained the certified monetary coordinator or chartered economic expert designation.

The Facts About Independent Investment Advisor Canada Uncovered

If you want expense advice most importantly: if you were to think your financial plan is in sound condition total nevertheless need help selecting and overseeing your opportunities, an investment expert may be the strategy to use. Such folks are frequently subscribed expense analysts or are employed by a company that will be; these advisors and advisory agencies are see page held to a fiduciary requirement.

If you'd like to delegate: This setup make feeling for extremely active people who just don't have the time or inclination to participate into the planning/investment-management procedure. It is also something you should think about for more mature people who will be worried about the potential for cognitive fall and its own affect their capability to handle unique finances or expense portfolios.

The Greatest Guide To Private Wealth Management Canada

The author or writers cannot very own shares in just about any securities mentioned in this post. Learn about Morningstar’s article guidelines.

Exactly how near one is to retirement, eg, or even the effect of major existence occasions including matrimony or having children. However these items aren’t in command over a financial planner. “Many take place randomly and aren’t anything we could impact,” says , RBC Fellow of Finance at Smith class of Business.

%20fee%20(1).png)

:max_bytes(150000):strip_icc()/fiduciary-fcde6a47733d4ecea06b608b4966a531.jpg)